Written by @AKWAnalytics

Commentary:

Bitcoin has been known as an “uncorrelated” asset due to its seemingly erratic price movements and unique financial properties, and now the tumult in Greece has pretty much completely decoupled the cryptocurrency from other major legacy markets altogether. With that in mind, it continues to be a mystery what asset class, if any, is a decent proxy for the price of bitcoin over the long term. You would think that, at the very least, the US dollar would be a decent guide for price, but as we will see below even this relationship is tenuous at best.

What is clear is that political uncertainty, banking troubles, and currency worries are all drivers of bitcoin’s price in the near term, while it continues to appear as though technicals are driving the longer term trends. The recent rally was nice, and most certainly a product of European and Chinese uncertainty, but with the Greek can now kicked down the road yet again it is critical that bitcoin hold support in order to confirm the current potential bearish to bullish trend reversal. If support between 220 and 230 $ cannot hold, then it will be another long, hot summer for the crypto bulls.

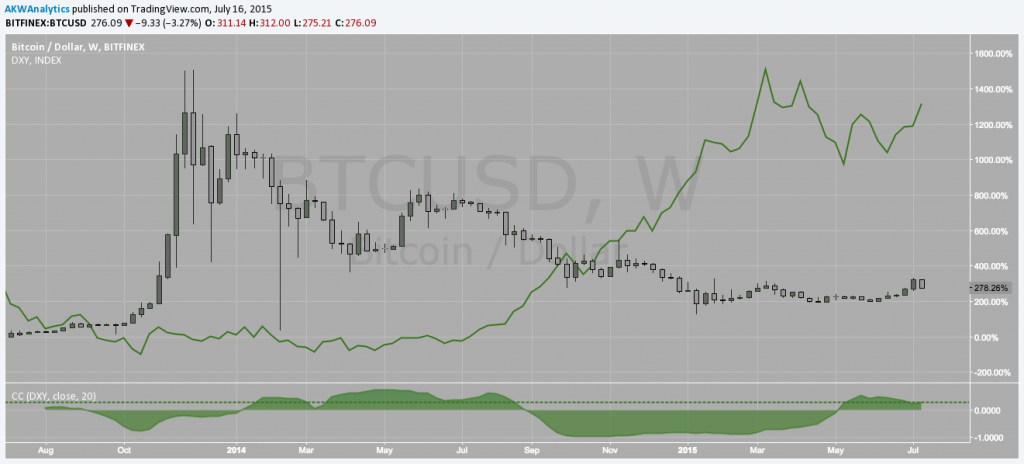

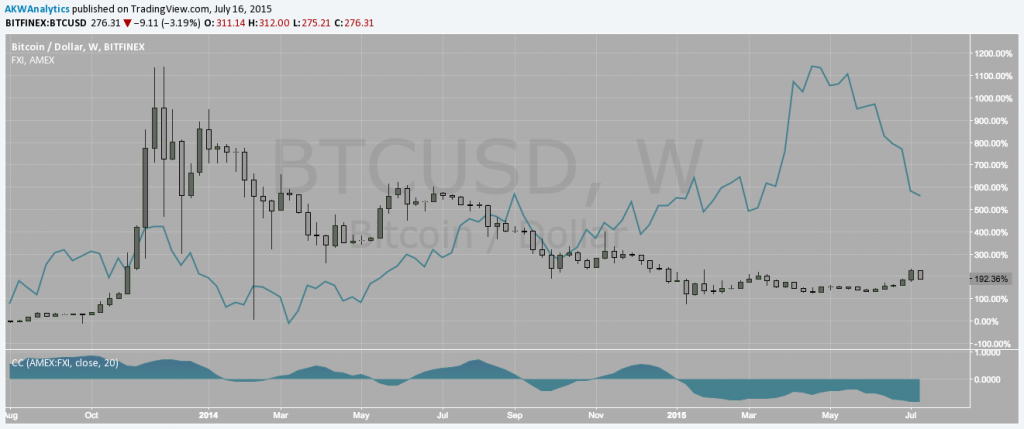

**bitcoin/US dollar**

There are some interesting things happening on this chart. First of all, we can see that the strong inverse correlation between bitcoin and the US dollar that existed from September 2014 until May 2015 has reversed and is now slightly positive. While it is difficult to determine whether this change is due to a shift in the dynamics of the underlying relationship or is due to exogenous event risk posed by Greece, what we can say is that bitcoin seems to be moving independently.

There is one thing to watch, however, that can give us an idea of what some future possibilities are. We can compare tops and bottoms in the two currencies and see if there are any noticeable divergences at price extremes. For example, when USD was making its double top back in the spring of this year, bitcoin was making a double bottom. Fast forward, as the US dollar has now put in at least a near term double bottom, bitcoin has been moving unexpectedly higher as well! This tells us that either bitcoin is relatively strong and will continue to rally despite what the dollar does, or it could telegraph an overextension in bitcoin that needs to be corrected with further downside.

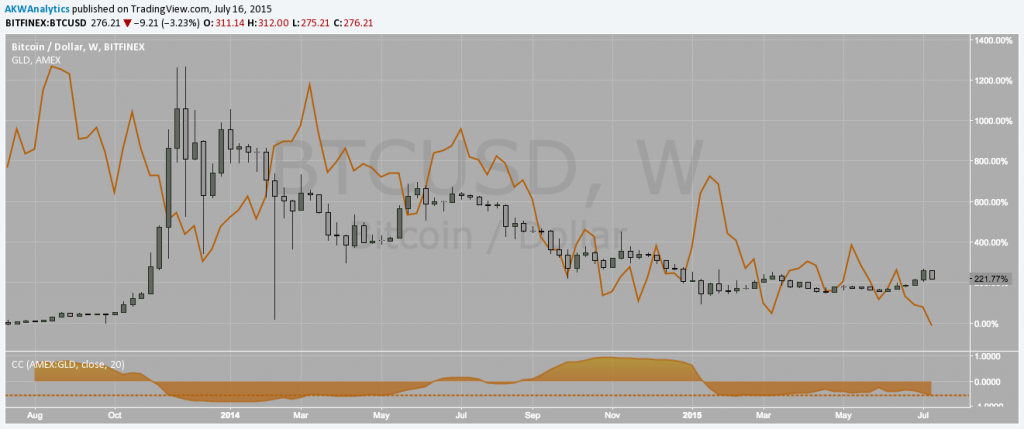

**bitcoin/gold**

While a positive correlation between gold and bitcoin might seem reasonable from an intellectual perspective, the market continues to tell us that that assumption is incorrect. We can see that a very strong relationship existed between the two assets for a short time during the fall of ’14, but that trend was short lived as bitcoin stabilized while gold continued to make lower lows. It seems that the market is telling us that bitcoin and gold are not complimentary goods, but are, at least for now, substitute goods.

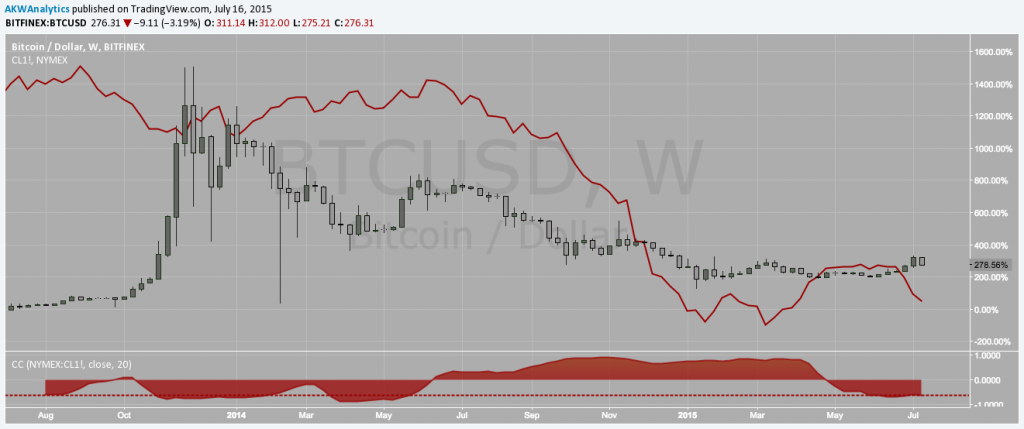

**bitcoin/oil**

As we have been watching the relationship between oil and bitcoin develop over the past few months, we have noticed something interesting that escaped us in the previous reports. That insight is that oil MIGHT be a leading indicator for the price of bitcoin! Back in late 2013 as oil was putting in its intermediate term top around the 115 $ level, bitcoin was rallying hard during its third bubble. Oil then put in a short term bottom right around the new year just as bitcoin was beginning to roll over to the downside. Bitcoin then rolled over as well and followed oil to the downside for the next six months!

Moving forward to this year, oil put in a decent looking double bottom a few months before bitcoin put in its January bottom, but it now appears as though they might be decoupling as oil heads back down and bitcoin remains elevated. It is still too early to tell if the relationship is broken or if bitcoin is about to follow oil to the downside, but it is certainly worth watching.

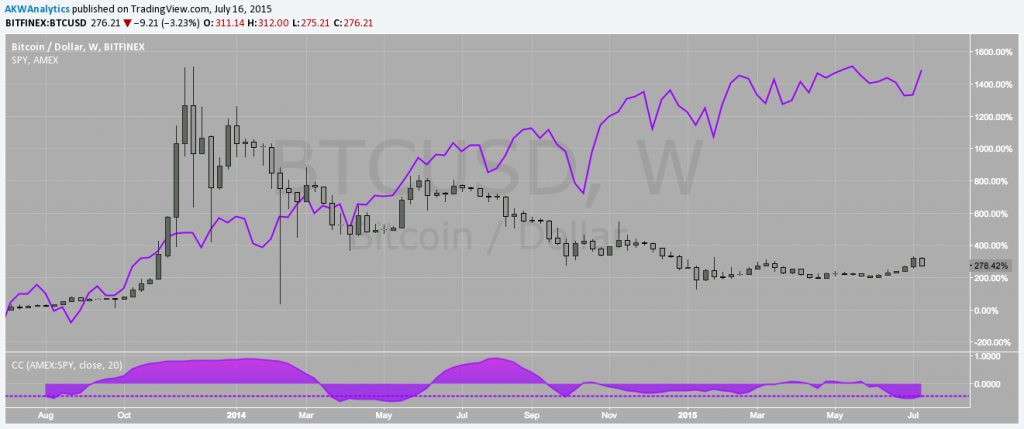

**bitcoin/US stocks**

We continue to believe that any attempt to explain a perceived relationship between bitcoin and US stocks is futile. The S&P 500 has been in a bull market since bitcoin’s monetary inception, and as you can see from the chart above there has never been a clear relationship between these two assets (nor should there be in our opinion). Stocks can continue to move higher, as they are designed to do, while bitcoin will remain independent of the paper asset market.

**bitcoin/Chinese stocks**

As opposed to US stocks, we think that Chinese stocks do have an effect on the price of bitcoin, at least in the short term, given how popular digital currency trading is and how many people (capital) there is over there. It should come as no surprise that as the Chinese markets have plummeted over the past few months, bitcoin has caught a bid. While we know that some of this demand was coming from Western speculators betting on the Greece situation, we also think that some of the rally above 300 $ was due to Chinese retail traders wanting a place to put paper profits during uncertain times.

There is still not enough evidence to assert that these two assets are actually correlated in any meaningful way, but it will be interesting to watch what happens to the price of bitcoin as the Chinese markets weather the current storm.

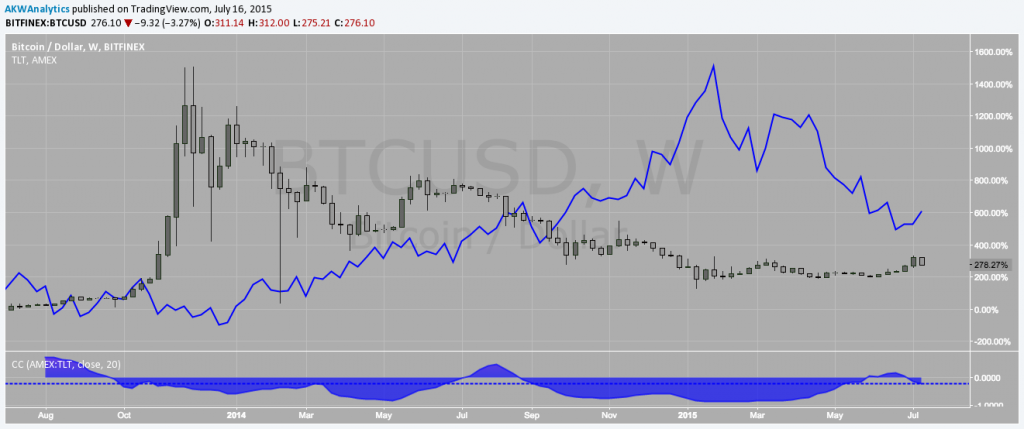

**bitcoin/bonds**

Ever since we began issuing these reports, the strongest and most surprising correlation has been between bitcoin and US Treasuries! It was hard to believe at first, but began to make sense in the context of debt risk and perceived safe havens. In the past, it was logical that bitcoin be treated as a risky, fringe asset that moved inversely to the global “risk free” US bond market. However, recently that strong negative correlation has evaporated as Grexit fears reached a fever pitch.

We suspect that, at least in this case, the past will not be indicative of the future as investors come to terms with how different the use cases are for these two assets.

Until next time!!!

Cheers,

@AKWAnalytics

—

To learn more about the bitcoin forecast above, or to gain access to the full Weekly Report, Daily Updates, and real-time Price Alerts please visit bullbearanalytics.com today!

For more information on the Bitcoin BullBear or Crypto BullBear (Monero & Dash), as well as how to subscribe to our Premium Services, please visit the Bitcoin BullBear today!

Join Today for Full Access!

Happy trading and have a great BITday!

Disclaimer: Please always do your own due diligence, and consult your financial advisor. Author owns and trades bitcoins and other financial markets mentioned in this communication. We never provide actual trading recommendations. Trading remains at your own risk. Never invest unless you can afford to lose your entire investment. Please read our full terms of service and disclaimer at terms-conditions-disclaimer/.