Written by @AKWAnalytics

GLOBAL MARKETS SEE RELIEF RALLY ON GREEK BAILOUT HOPES, BUT SUSTAINABILITY IS QUESTIONABLE.

As investors await an outcome and hope for the best in Greece, global equity markets are bouncing within a range. We can’t help but think that this will end up being a sellable rally given the uncertainty surrounding Europe, China, Puerto Rico, and US interest rates. A flare up of any one of these macro risks could put a halt to the risk-on trade and send capital fleeing back to safe havens.

Forex

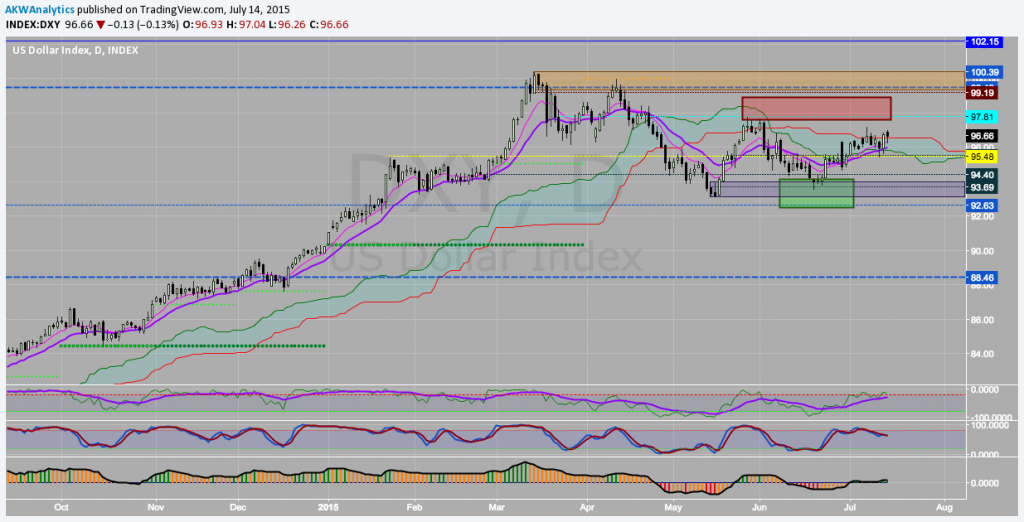

For the past few weeks we have been showing the EURUSD pair, which also remains range bound, but today we wanted to look at the US Dollar Index as it is the main influencer of all the major currency pairs. The main fundamental driver of the price of the dollar right now is Fed interest rate policy. If it continues to look like they will raise in September, then we will be looking for a breakout to the upside from the current consolidation. If, on the other hand, it appears as though Yellen will hold off until 2016, then the dollar will be a sell at these levels. Until we get more clarity, however, the market should remain on a sideways trajectory.

Technically speaking the daily chart is telling us the same thing as Willy is already getting overbought, the Stochastic has rolled over, and price action is unimpressive. Conversely, the institutional EMA’s are still pointing higher, the Ichimoku Cloud has been broken, and there is some room to run up to the top of the range and OTE short zone. We would not be surprised to see the dollar move higher into resistance around 98 before pulling back into the range. Trade USD pairs accordingly.

US Dollar Index Daily

Stocks

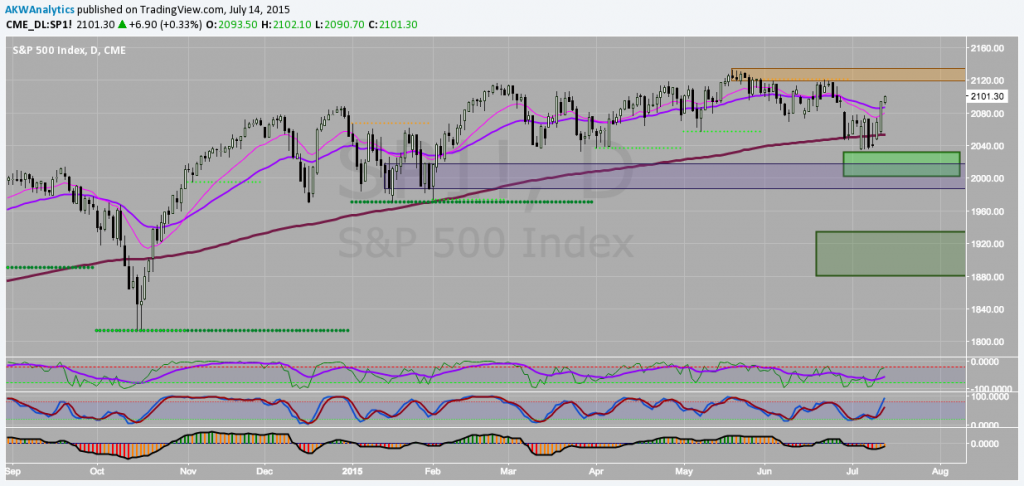

US stocks have seen a nice relief rally off of the lows of last week which is now gaining steam to get above the 2110 level today. We expect this bounce to continue up to the supply area shown in orange unless one of the risks we mentioned above presents itself, which would not surprise us given that the S&P 500 is now at a short term OTE sell level. That said, the 200day MA has held so far and buyers came into the market just as price was approaching the medium term OTE long area. Additionally, Willy and the Stochastic have some room to run to the upside.

Again, this market is range bound and should remain so until we get some definitive resolution to one of the four big risks we see to the risk rally.

S&P500 Daily

Metals

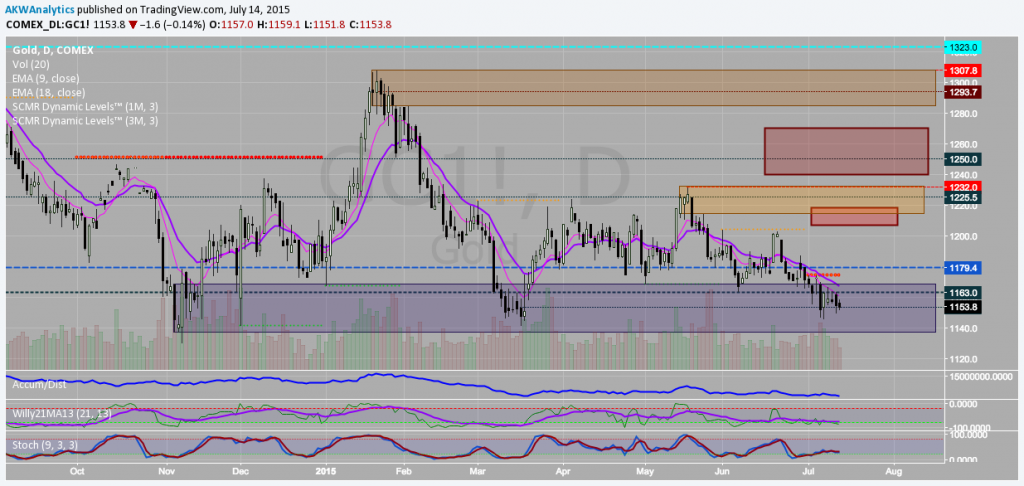

Gold has continued to underperform as expected, but is now at a price level that we find interesting from a buyers perspective. Also, the mainstream media and social media seem to have forgotten about the precious metal altogether as price has languished during a period of perceived currency risk. While we are not believers in triple bottoms, we do think that there are a number of other technical signals that are pointing to a countertrend bounce in the near future.

The daily chart is looking rather bullish as price is now well within a predefined demand area and has found support at a previous bullish order block. Additionally, Willy is now stupid oversold, the Stochastic is divergent, and sell volume is waning at these levels. While there will be resistance in the 1175 to 1180 $ area in the near term, with only a 10 $ stop down to the 1145 $ local low from current levels you have a 2.5:1 r/r just on the 280 $ scalp alone. By no means are we now bullish of gold from an investor standpoint, but it may be time to see some upward action.

Gold Daily

Happy Trading!

Cheers,

@AKWAnalytics

—

To learn more about the BullBear Analytics, or to gain access to our full line of Weekly Reports, Daily Updates, and real-time Price Alerts for bitcoin and other cryptocurrencies, please visit bullbearanalytics.com today!

For more information on the Bitcoin BullBear and Crypto BullBear, or on how to subscribe to our Premium Services, please visit BullBear Analytics today!

Join Today for Full Access!

Happy trading and have a great BITday!

Disclaimer: Please always do your own due diligence, and consult your financial advisor. Author owns and trades bitcoins and other financial markets mentioned in this communication. We never provide actual trading recommendations. Trading remains at your own risk. Never invest unless you can afford to lose your entire investment. Please read our full terms of service and disclaimer at terms-conditions-disclaimer/.