Written by @AKWAnalytics

INVESTORS EYE CHINA MARKETS LIKE A HAWK AS GOVERNMENT INTERVENTION FALLS SHORT OF EXPECTATIONS

There is no doubt that the world is watching China with anxiety as government measures to stem the selling have gone largely ignored by the markets. While they may have been successful in keeping losses smaller than they otherwise would have been, we think any attempts to reinflate the stock market will be abject failures. Once short selling bans and direct asset purchases cease, the intense selling should return which will inject significant volatility into global markets already shakey from questionable economic growth.

That said, markets should see a risk-on relief rally based on oversold technicals and seasonality, perhaps even to nominal new highs, but it will be short-lived as reality about China and global growth return just in time for a “Fall fall”.

Forex

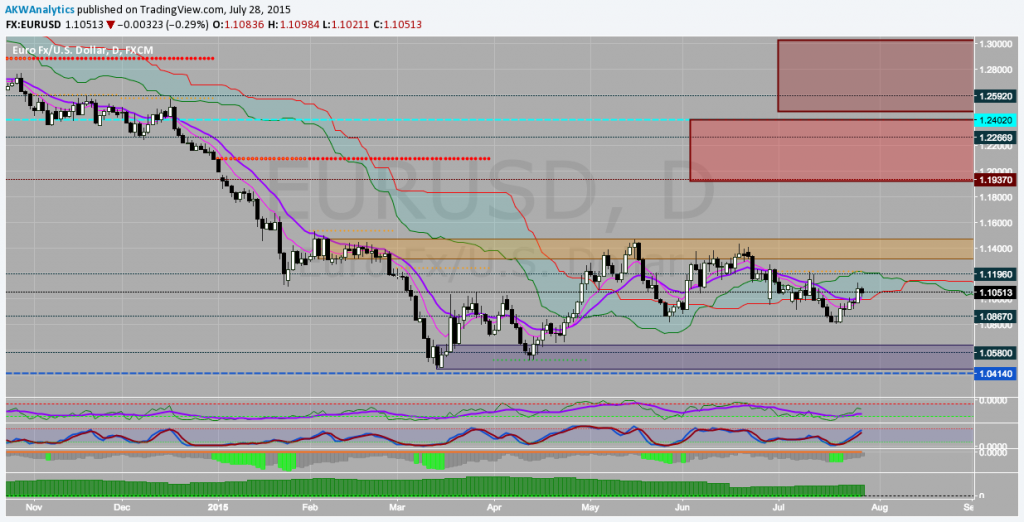

Last week we showed a chart of the US dollar index, but want to return to EURUSD to exemplify just how range bound these major forex pairs are. Following a selloff below 1.10 over the past few weeks, the euro caught a bid on a double bottom recently. Now price is heading back up to a supply zone around 1.14, although we should see some resistance come in around the 1.12 area. This is where we would be looking to get short, at least on a scalp, as this will complete a stop run and is an OTE short zone. Longer term we remain bearish on EURUSD, but will stay neutral in the near term as the range continues to hold (1.05-1.15).

EURUSD Daily

Stocks

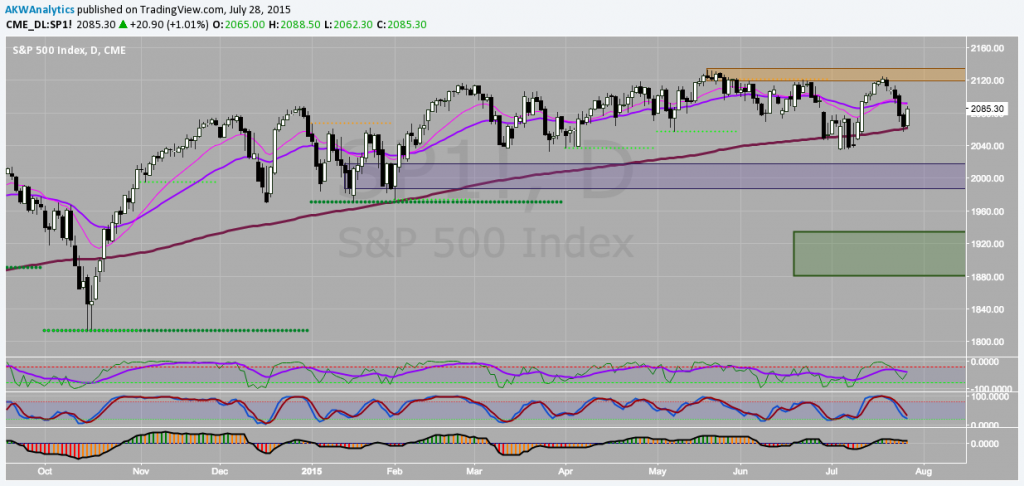

China worries have put pressure on US stocks recently, as have less than impressive earnings (guidance) from S&P 500 companies, although not as much as one might think. In fact, the US markets remain in the same choppy pattern that they were in when Chinese shares were skyrocketing. This makes sense from a purely economic standpoint as very few investors own A-shares in China, however from a confidence perspective this will have long lasting effects in our opinion.

Technically speaking, you can see that price has rebounded nicely off of the 200day moving average, but is already about to hit an area of resistance in the form of the institutional EMA’s. Additionally, Willy is chopping around in no man’s land, the Stochastic is weak, and ergotics are ok but not great. At this point, given where we are in the summer trade, we think a continuation of the rally is in the cards over the next week or two. Having said that, we also think a new ATH will be a great opportunity to get short for a larger pullback going into the seasonally weak Sept-Oct time period.

S&P500 Daily

Metals

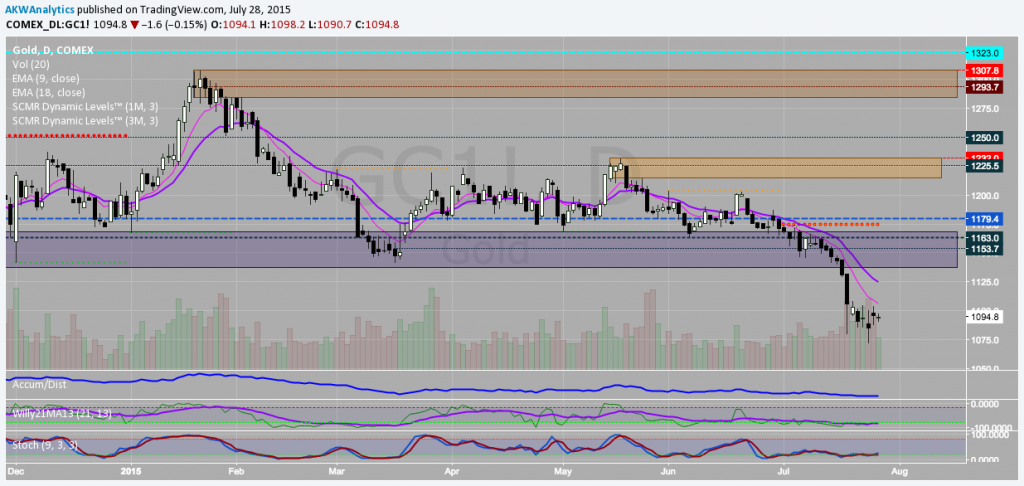

Gold has gotten killed lately (which apparently is good for bitcoin!), and currently it is hard to find a reason to accumulate the yellow metal for the longer term (yet). If nothing else, we think gold will chop around between 1050 and 1150 $ for the time being as the US dollar continues to consolidate in a range for the remainder of the summer. Going into the fall, however, we will need to monitor price action at key levels in order to try to catch a trade in this market. For now, gold is a no touch for us despite the potential for a countertrend move back up to the 1150 $ level. Sell that rally.

Gold Daily

Happy Trading!

Cheers,

@AKWAnalytics

—

To learn more about the BullBear Analytics, or to gain access to our full line of Weekly Reports, Daily Updates, and real-time Price Alerts for bitcoin and other cryptocurrencies, please visit bullbearanalytics.com today!

For more information on the Bitcoin BullBear and Crypto BullBear, or on how to subscribe to our Premium Services, please visit BullBear Analytics today!

Join Today for Full Access!

Happy trading and have a great BITday!

Disclaimer: Please always do your own due diligence, and consult your financial advisor. Author owns and trades bitcoins and other financial markets mentioned in this communication. We never provide actual trading recommendations. Trading remains at your own risk. Never invest unless you can afford to lose your entire investment. Please read our full terms of service and disclaimer at terms-conditions-disclaimer/.