| Free | CryptoEssentials | BitcoinPro | AltcoinPro | Guru | |

|---|---|---|---|---|---|

| Price | Free | $99/mo | $149/mo | $199/mo | $899/qtr |

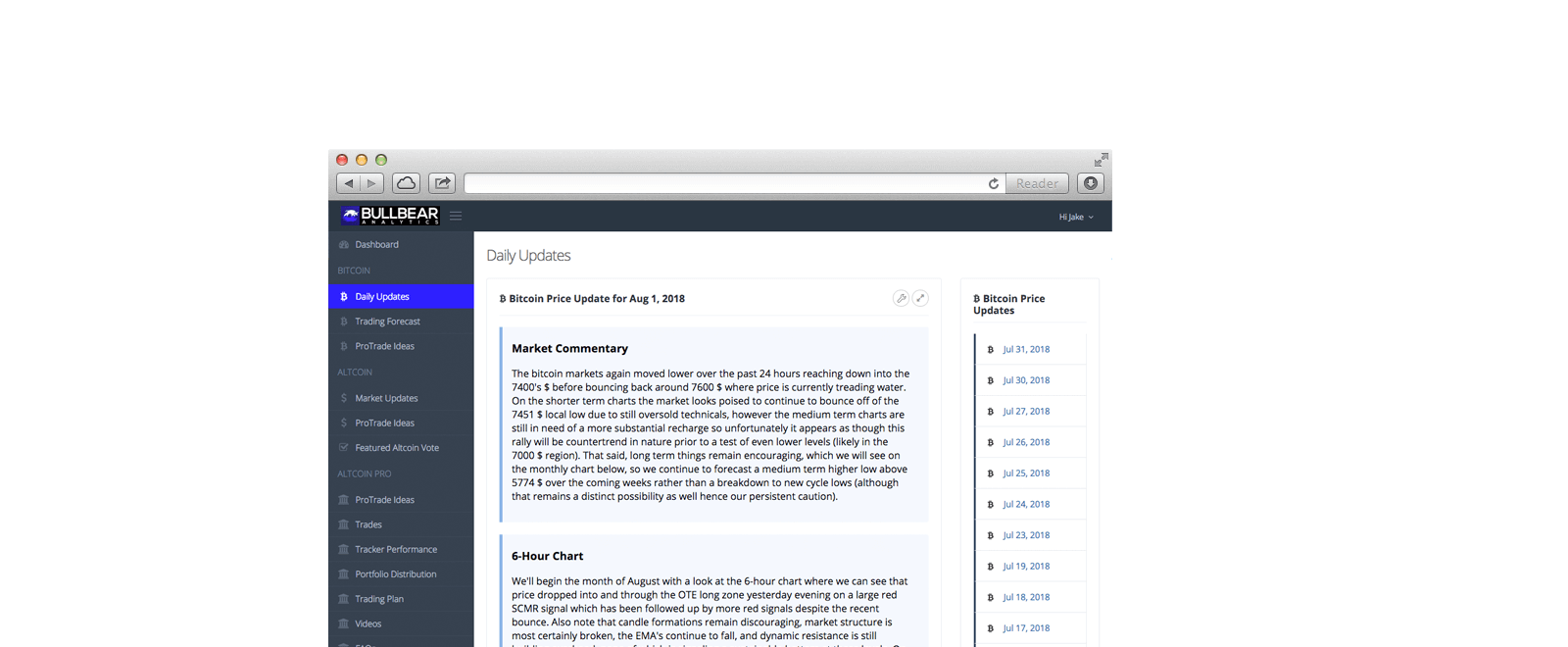

| BBA Hub | |||||

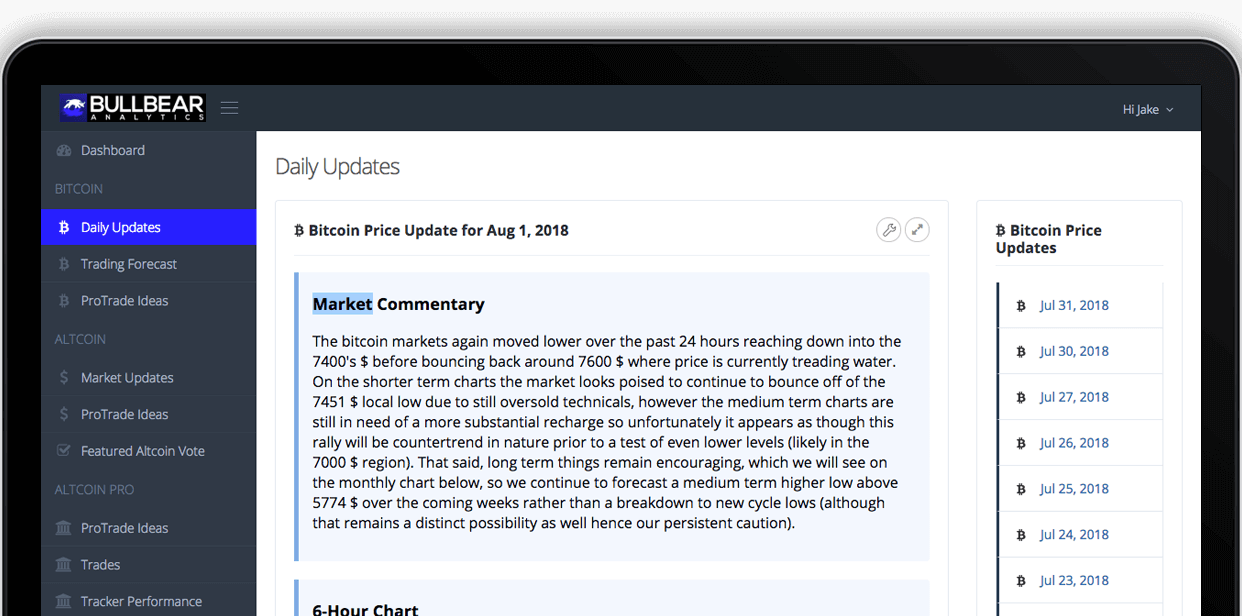

| Hub Access | Limited | ✔ | ✔ | ✔ | ✔ |

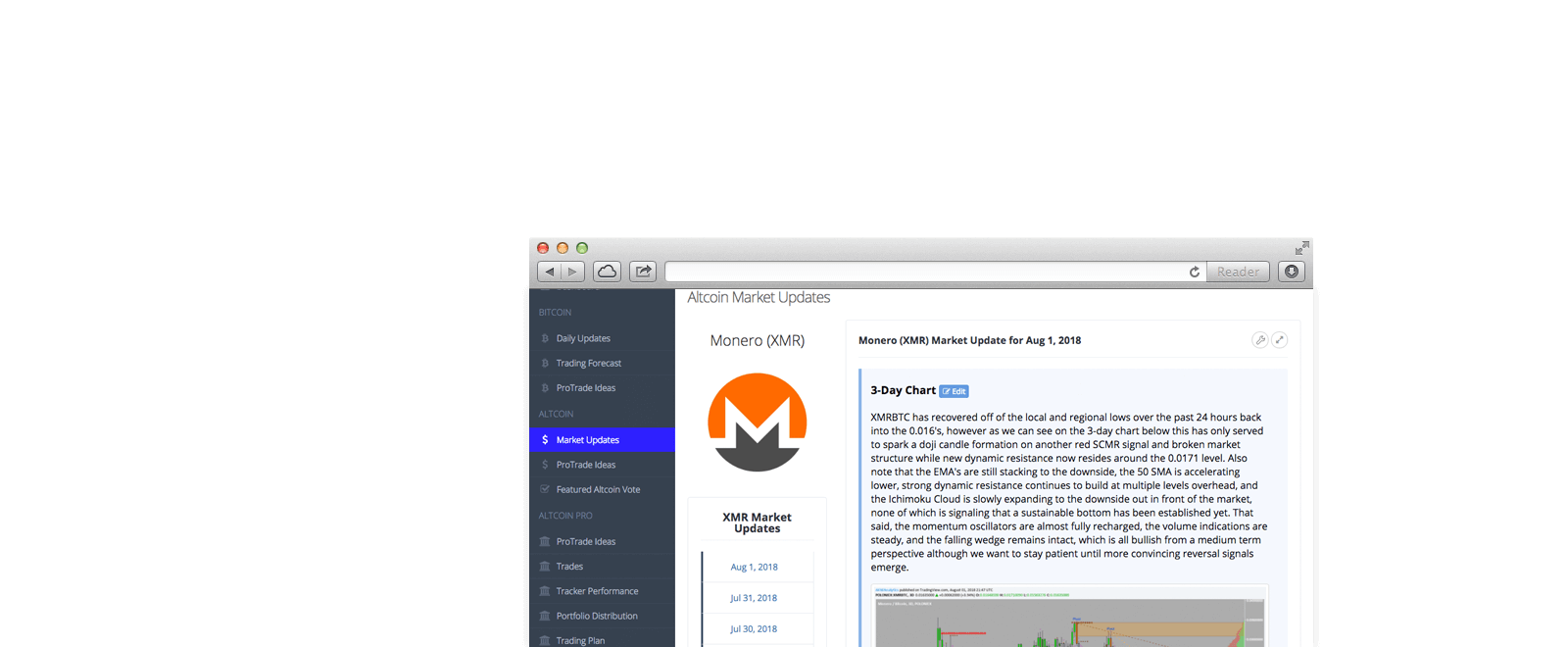

| All Bitcoin Updates | Redacted | ✔ | ✔ | ✘ | ✔ |

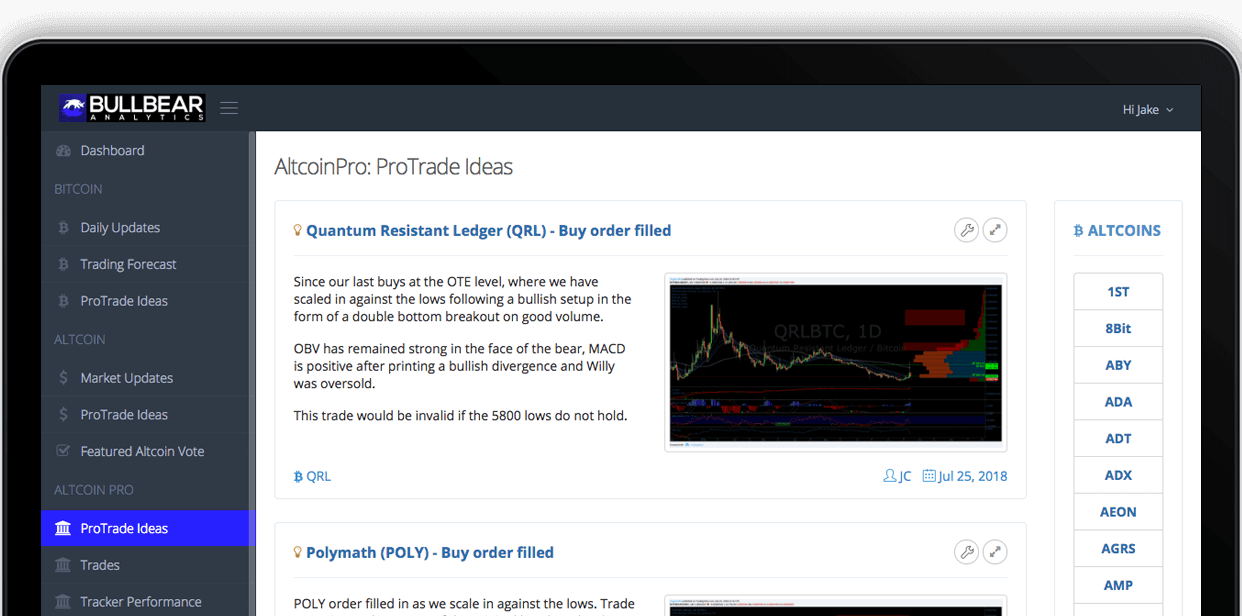

| All Altcoin Updates | ✘ | ✔ | ✘ | ✔ | ✔ |

| All AltcoinPro Updates | ✘ | ✔ | ✘ | ✔ | ✔ |

| Slack Channels | |||||

| #general #fundamentals #ICO #mining | ✘ | ✘ | ✔ | ✔ | ✔ |

| #bitcoin #bitcoin-quickfire | ✘ | ✘ | ✔ | ✘ | ✔ |

| #altcoin #altcoin-quickfire #altcoin-pro #altcoinpro-alerts | ✘ | ✘ | ✘ | ✔ | ✔ |

| Direct Chat with the Expert Analysts | ✘ | ✘ | ✘ | ✘ | ✔ |

| Join Today | Free | CryptoEssentials | BitcoinPro | AltcoinPro | Guru | Monthly | Free | $99/mo Use Card/PayPal Use Crypto | $149/mo Use Card/PayPal Use Crypto | $199/mo Use Card/PayPal Use Crypto |

| Quarterly | $399/qtr Use Card/PayPal Use Crypto | $499/qtr Use Card/PayPal Use Crypto | $899/qtr By Application | ||

| Yearly | $1,399/yr Use Card/PayPal Use Crypto | $1,749/yr Use Card/PayPal Use Crypto | |||

Known as the original "Bitcoin Analyst" (@bullbearanalyst), BBA has been doing this since 2010 and it shows. We provide you with the most insightful market commentary, actionable trade ideas, and presciently timed calls in order to help you consistently beat the market makers on a regular basis.