Originally published in The Bitcoin BullBear Report released on 7/9/2015. Written by @AKWAnalytics.

Contrary to what we have become accustom to over the past year, that being consistently lower prices in a bear market, the past few months have been very encouraging for the remaining bulls out there. While we want to see price pullback from here, we want to buy the dip for the first time in months.

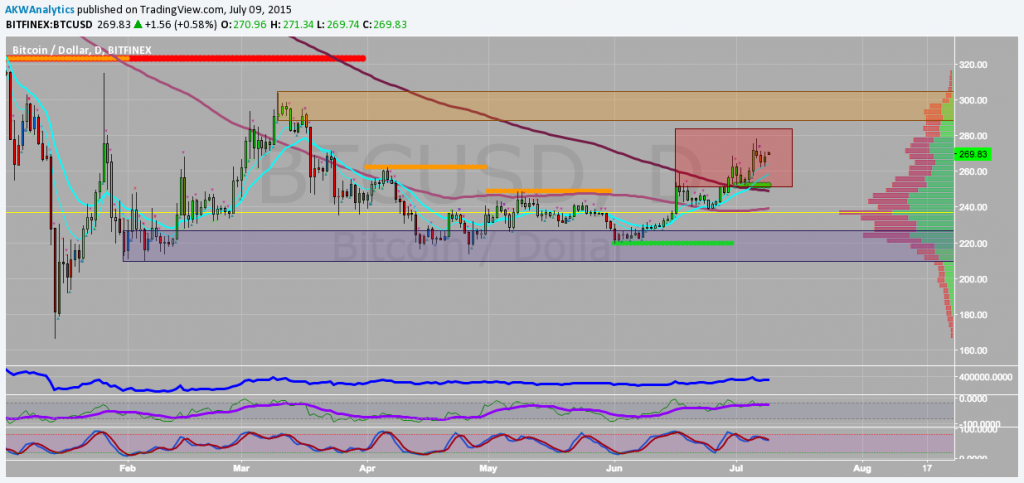

It is no surprise to us that bitcoin is running into a bit of resistance at current leves as price has entered into an intermediate term sell area on the daily chart. Additionally, fear and uncertainty surrounding the Greece situation has been put on the backburner for the remainder of the week as the market is on hold until the ECB meeting on Sunday. That being the case, all eyes have turned to China’s stock markets which has been in a freefall for about the past week.

What this did is shift the market’s attention away from political risk in Europe to financial risk in China, which is not nearly as positive for bitcoin as a broken Eurozone. We can see this shift most clearly in the Japanese Yen forex pairs as they have been rallying strongly over the course of this week. A stronger Yen is indicative of global financial uncertainty as despite an infinitely dovish BoJ, Japan’s debt is internally held which translates into some form of “safe money” during these bizarre times. While we expect this trend to abate and then revert back to focus on Europe next week, for now we think a continued consolidation in the bitcoin market will provide a good buying opportunity prior to a return to focusing on the EU early next week.

Remember, the crisis in Europe is a political one not a currency one. At the time being, the Euro is surprisingly stable and no one is talking about a currency collapse. The real risks are posed by unaccountable politicians who feel that conservation of a fraudulent system is more important than the well being of it citizens. Capital controls, bank shutdowns, and ATM lines are all good reasons to buy bitcoin in our opinion. Falling stocks in China is not.

Cheers,

@AKWAnalytics

To learn more about the bitcoin forecast above, or to gain access to the full Weekly Report, Daily Updates, and real-time Price Alerts please visit bullbearanalytics.com today!

For more information on the Bitcoin BullBear and Crypto BullBear, or on how to subscribe to our Premium Services, please visit BullBear Analytics today!

Join Today for Full Access!

Happy trading and have a great BITday!

Disclaimer: Please always do your own due diligence, and consult your financial advisor. Author owns and trades bitcoins and other financial markets mentioned in this communication. We never provide actual trading recommendations. Trading remains at your own risk. Never invest unless you can afford to lose your entire investment. Please read our full terms of service and disclaimer at terms-conditions-disclaimer/.