Ethereum Price Report for December 9, 2016

Dec 9, 2016 --- (ARCHIVED) Altcoin Price Reports

Market Commentary:

The kickback from an incredibly oversold market earlier this week continues as late shorts continue to get squeezed which has driven price well above 100. Now we are getting back into an area of historical resistance which could prove difficult to penetrate without actual new demand coming into the market. This may be possible considering there is a new altcoin hedge fund that was just publicly announced, although we doubt $10 million is enough to sustainably move a market as big as ETH. For the time being we continue to rely on the technicals for guidance as to directionality and timing considering has been very profitable to do so recently.

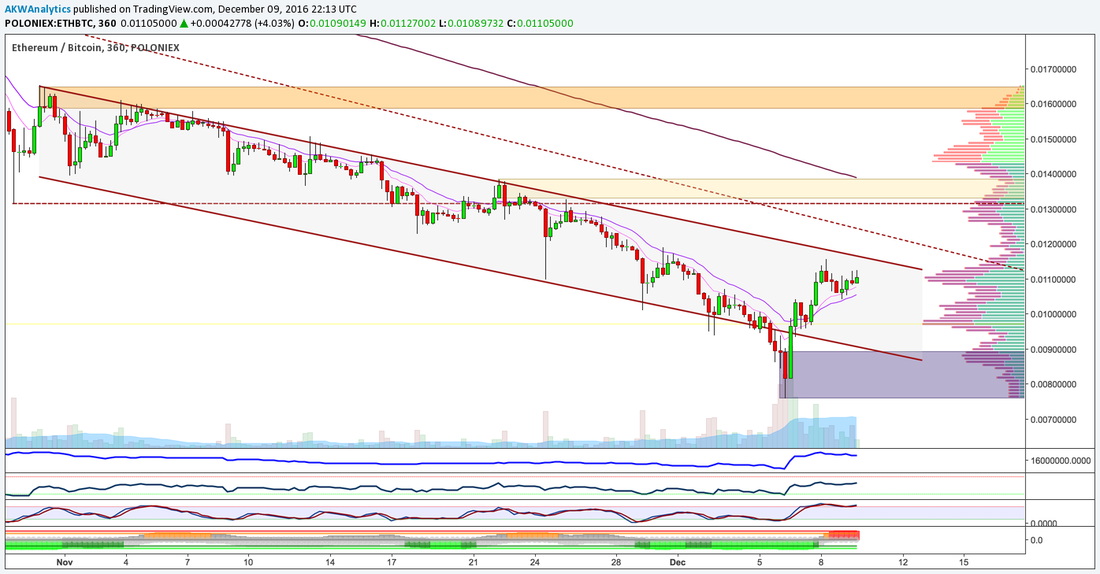

We can see on the 6-hour chart below that the current countertrend bounce has been fairly impressive, however so far all it has been able to do is get price back within the descending channel that it has been in for the past month plus. Also notice that despite what are [members-only text] SCMR candles, there is still not much in the way of [members-only text] and price is already being rejected at the bottom of the lower [members-only text] zone.

Additionally, volume profile remains porous below the market, the A/D line continues to give back the rally gains, and exchange volumes are [members-only text]. Throw in the fact that Willy and the Stochastic are back in overbought territory, RSI is still stuck in no mans land, and PPO is flashing strong sell signals, and we think at least a retest of [members-only text] is in order prior to another leg higher which could break price out of the downtrend channel.

Generally speaking we are still not fans of this market on any timeframe, especially following the close of what was a very profitable long trade over the course of this week (up 40.13%!). Having said that, there could be some opportunities presented us as traders in the not too distant future if bitcoin can crank up the volatility machine, hopefully to the upside. Regardless, we will be ready and waiting on both sides of the market.

ETH ProTrade Ideas:

1). **Very Short term**: No new ProTrades at this time considering poor risk/reward profiles on both sides of the market.

(b). **[ENTERED @ 78 on 12/6/2016; CLOSED @ 110 on 12/8/2016 for 41.03% PROFIT]**: We will have closed the LONG position off of the 78 level at the intended target of 110 for 41.03% profit in three days.

2.) **Medium Term [UPDATED on 12/9/2016]**: We will consider a SHORT position on a rally up to the [members-only text] area with a stop around the [members-only text] level and a target of [members-only text].

3.) **Long Term [UPDATED on 12/9/2016]**: We will consider a LONG position on a pullback to the [members-only text] area with a stop around the [members-only text] level and a target of [members-only text].

**Premium members get to see live trades complete forecasts, and full charts everyday.

To get your access to our edge, subscribe today.**