Originally published on myownmasterblog.wordpress.com on 12/31/2015. This is a guest post written by @RichGodwin_JD.

I wanted to write this, because I’ve noticed a general unawareness of global macroeconomic trends that are currently playing out in the world. I’m interested in how these trends will affect certain asset prices – especially bitcoin. There’s been a lot of chatter about whether Chinese capital flows have previously and presently affected the bitcoin price. I wanted to put forth my two cents on the topic.

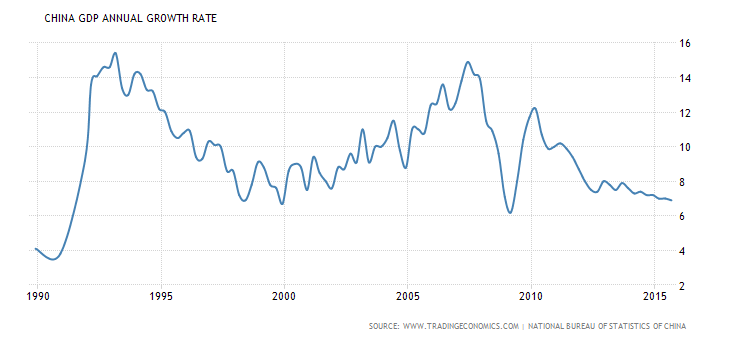

Unless you’ve been living under a rock for the past decade, you know that China’s economic growth has been explosive. With consistent (reported) growth at or above 7%, they have risen to be the world’s second largest economy. Those staggering levels of growth beg the question – how have they done it? One word: Debt.

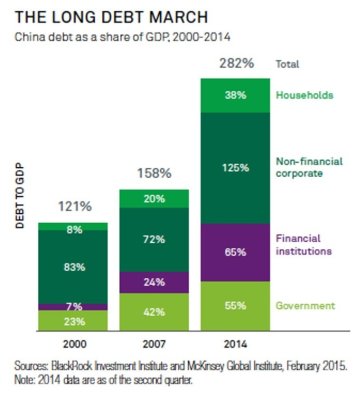

China has ridden the back of a massive debt expansion program since 2009 in an effort to maintain its ridiculous levels of growth. Much like using duct tape to patch a hole in the side of a dam, the credit expansion effects are beginning to deteriorate. While the amount of credit extended to the public has skyrocketed since 2009, the correspondent growth has stayed the same at best (and disappeared at worst).

It’s pretty common knowledge that debt-fueled growth, while prosperous in the short-term, typically leads to a deflationary, default-driven economic bust in the long-term. That is the essence of the business cycle. It would be to ignore all of the historical examples that have already followed the same path if China did not understand that.

Let’s face it – China won’t be growing its way out of debt. Ever. It’s just not possible.

I find it hard to believe that China doesn’t have a plan in place to address these seemingly insurmountable debt levels. President Xi Jinping has been executing a plan for sustained growth all along – why would that change now? Maybe I’m giving them too much credit, but I’m going to operate from this assumption to make the case that there could be a major yuan depreciation coming down the pipeline.

Why does yuan depreciation make sense? The easiest and quickest way to decrease a massive debt burden is to let your currency depreciate. Even the U.S. likes to use inflation as a way to shrink its debt burden. However, depreciation and inflation are significantly different – especially from the perspective of an investor.

The Reign of King Dollar

Dollar credit extended to non-bank borrowers outside the U.S. has ballooned to between $6 and $9 trillion since 2009.[1] In essence, this has been the global carry trade of the last half-decade. Foreign investors looking to invest in China make up a large portion of this credit.

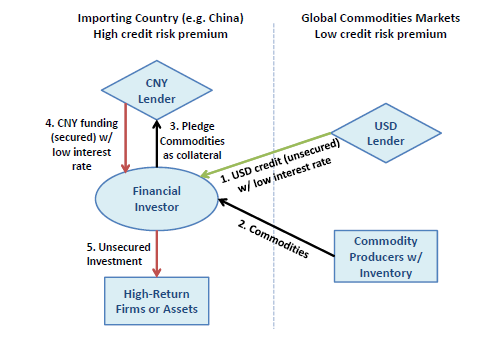

To explain what I mean by the global carry trade, I’ll use a real life example. In China, there is a highly popular method for foreign investors to fund Chinese businesses that involves using imported commodities as collateral for domestic secured loans. Capital controls and financial friction make it difficult for new businesses in China with very high expected returns to attain unsecured loans without being hit with exorbitant interest rates.

Foreign investors see that Chinese banks are charging high interest rates for the unsecured loans, and see an opportunity to make some money off the spread between unsecured and secured loan interest rates. These investors can borrow at low unsecured interest rates in the U.S., buy commodities and import them into China, pledge those commodities as collateral to receive a low interest rate on a secured domestic loan, and invest in high-expected-return assets in the Chinese market.

The rationale behind this process is that the investor believes, all else being equal, she’ll be able to make a profit off the return she will get from investing in the high-expected-return assets that is greater than the interest she will pay on the borrowed U.S. dollars and the secured loan interest rate charges in China. For quite some time, she was right, and made boatloads of money.

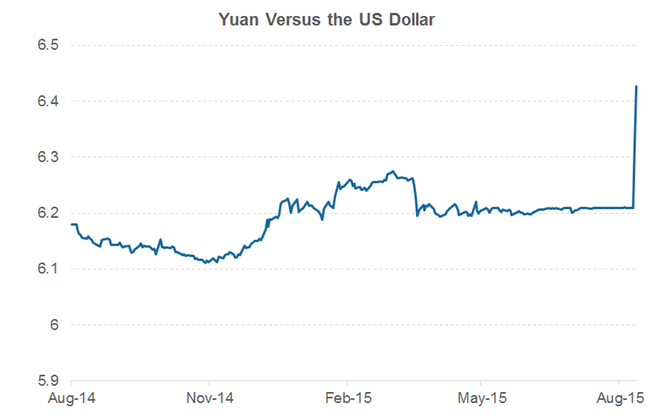

To most seasoned investors, this sounds enticing. But the problem occurs when the currency exchange rate begins to fluctuate against her, and the investor begins to lose money. If the Chinese yuan were to depreciate against the dollar, she would begin losing money because she’s essentially shorting the dollar.[3] She would have to rapidly close out her Chinese domestic loan to pay off her U.S. dollar loan to avoid a short squeeze. This problem is accentuated if the market price of the commodity securing the Chinese domestic loan begins to decline as well.

Well, the above scenario where the investor begins rapidly losing money on her investment is unfolding. As you can see below, overnight the yuan devalued against the dollar back in August of this year. There are signs that point to a further yuan depreciation in the near future.

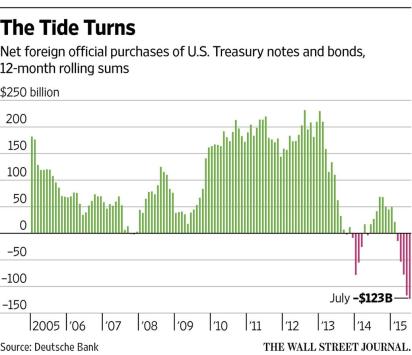

Chinese state-owned enterprises are refinancing their U.S. dollar denominated debts on the dim-sum bond market mostly at higher interest rates – a sign that firms are looking for wiggle room in the event of a major depreciation. Chinese gold holdings have increased. The PBOC (along with many other central banks) has been selling U.S. treasuries to load up on dollars as a way to defend the yuan as capital outflows have heated up.

In my opinion, the PBOC defending the yuan is only an effort to keep the yuan depreciation from happening abruptly all at once. It keeps the faucet at a slow leak instead of a fire hydrant burst. China needs more depreciation to ease its debt burden.

Why Depreciaiton Makes Sense

I want to share with you a clip from an interview that aired on Raoul Pal’s RealVision TV about a year ago. Raoul interviews legendary investor Mark Hart. Mark discusses China, and how they’ve been able to expand the dollar part of their balance sheet so drastically. He describes the period of Chinese economic growth during their role as a global manufacturer and producer.

“More dollars were flowing into China than flowing out, and that puts natural upward appreciation on the Chinese currency, and that’s exactly what we saw. It became, and it still has become actually, a one-way bet. Just extrapolate into the future, and it becomes a one-way bet.

“The way it works – dollars flow into China to an exporter, and the exporter takes the dollars and deposits them into a Chinese bank. The exporter needs yuan to pay their workers and to operate. Now all of a sudden the banks are long dollars, because they want the bank to convert the dollars into yuan.

“Banks are usually in the business of loaning out yuan – not dollars, so the banks have dollars to sell. Under normal circumstances that would put downward pressure on the dollar. But the Chinese didn’t want their currency to appreciate too rapidly. So, the PBOC became the buyer of last resort of dollars… soaking up dollars with newly created yuan. The central bank would purchase the dollars by printing money.”

This is why the PBOC has every incentive to let their currency devalue against the dollar. Even though the yuan side of their balance sheet depreciates, their dollar side of the balance sheet appreciates proportionally. And as the yuan depreciates relative to the dollar, paying of dollar-denominated debt becomes cheaper.

China has been reliant upon the aforementioned carry trade to keep growth rates high. But now that non-performing loans are rising, defaults are looming, and growth has stagnated, capital outflows present a serious risk to the Chinese currency. If the yuan depreciates, the debt becomes cheaper.

One way to hedge against the currency depreciation risk is to own dollars. Well, the PBOC has that covered. Another way is to own gold. Check. And even another way is to own … bitcoin.

Bitcoin and Gold

The Chinese government has recently made it a point to let the world know that it is buying gold. In July of this year, China broke silence on its gold reserves by announcing that it had increased its reserves by 60% since 2009 totaling 1,658 tons. While some analysts estimate that those numbers are actually closer to 25,000 tons, it doesn’t really matter what is the actual number. What matters is what this communicates to the Chinese population.

After a period of resistance and hesitance toward Bitcoin, the Chinese government “unofficially” came out in support of it recently. The People’s Daily – the official newspaper of the Chinese Communist Party – recently ran an article saying:

“Although some people think that bitcoin and its underlying technology, the blockchain, is not stable, we cannot ignore the revolutionary changes it brought to the financial sector. The new technology has led to the expansion of a distributed payment and settlement mechanism, which will innovate financial transactions.”

While this is not an official statement from the government, this newspaper is a major publication whose main readers are Chinese officials. Again, what matters here is what this communicates to the Chinese population.

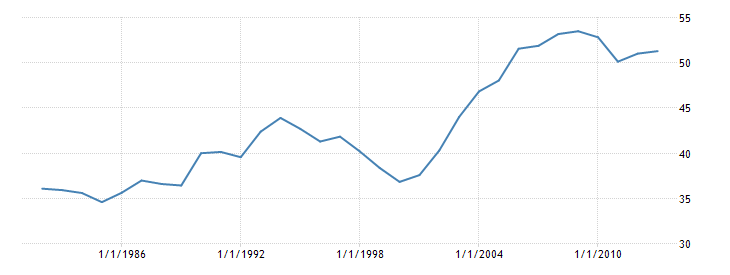

The Chinese population loves to save. From the Bank of International Settlements – “The nation saves half of its GDP and its marginal propensity to save (MPS) approached 60% during the 2000s (Zhou, 2009; ADB, 2009; IMF, 2009).”[5] China’s gross savings levels have averaged over 50% of GDP since 2009.

Savings as a Percentage of GDP

This is important, because if even a tiny percentage of Chinese citizens’ savings shifts into bitcoin, we could see a pretty hefty price swing upward.

Completing the Jigsaw Puzzle

How does this all play into my theory that China is setting up for large yuan depreciation? Let’s go back to my original position that President Xi Jinping has a plan to deleverage the massive amount of debt that has accumulated since 2009. The Chinese government announcing its gold holdings, coupled with the fact that they also seem to have subtly come out in support of Bitcoin might be an indication that the government wants its citizens to begin shifting some of their savings into gold and Bitcoin. And this makes sense if they see that the yuan needs to devalue. I understand that this might be a stretch to think that the Chinese government would want its citizens to engage in circumventing capital controls. Regardless of whether that’s the case, bitcoin stands to benefit as the yuan begins its long road of depreciation.

Turning back to all the chatter about bitcoin being used as a method of capital flight from China, I don’t think bitcoin ownership is so much about capital flight as it is capital preservation. Yes, you can easily send bitcoin out of China, and this is attractive if you’re afraid the government will look to confiscate your wealth. But if you’re like me, and you see bitcoin as a great store of value – especially while your country’s currency is depreciating – bitcoin looks exceptionally attractive without the need for it to leave China’s boarders.

[1] http://www.bis.org/publ/work483.pdf

[2] For an excellent discussion on the effects of the commodity collateral financing in China, check out:http://www.mit.edu/~zhuh/TangZhu_CommodityCollateral.pdf

[3] The People’s Bank of China recently devalued their currency against the dollar. You can read more about it here:http://money.cnn.com/2015/08/11/investing/china-pboc-yuan-devalue-currency/

[4] Image from http://www.wsj.com/articles/once-the-biggest-buyer-china-starts-dumping-u-s-government-debt-1444196065

[5] http://www.bis.org/publ/work312.pdf?noframes=1

[6] http://www.tradingeconomics.com/china/gross-savings-percent-of-gdp-wb-data.html

—

To learn more about the bitcoin forecast above, or to gain access to the full Weekly Report, Daily Updates, and real-time Price Alerts please visit bullbearanalytics.com today to get your ExpertPro Package today!

For more information on the Bitcoin BullBear and Crypto BullBear, or on how to subscribe to our Premium Services, including our most popular product, ExpertPro Monthly, please visit BullBear Analytics today!

Join Today for Full Access!

Happy trading and have a great BITday!

Disclaimer: Please always do your own due diligence, and consult your financial advisor. Author owns and trades bitcoins and other financial markets mentioned in this communication. We never provide actual trading recommendations. Trading remains at your own risk. BullBear Analytics publications are meant for entertainment purposes only. Never invest unless you can afford to lose your entire investment. Please read our full terms of service and financial disclaimer at BBA Disclaimers & Policies.

[6]

[6]