Originally published in the Bitcoin BullBear Weekly Report released on 2/19/2015. Partial excerpt only. Written by @AKWAnalytics.

Following the announcement of another USMS SR bitcoin auction of 50,000 btc, the market took a 5% haircut prior to partially recovering over the course of that night. Now price is struggling to move much at all in either direction as it seems to be stuck between support and resistance.

Despite the negative market reaction to the SR news when it was announced, we think it is a good thing in the long run as this charade comes to an end. Following this auction the USMS will have 44K bitcoins left to sell, most likely this upcoming summer, after which we can thankfully move on bigger things. That being said, its not over yet and there are reasons why this is bad for bulls in the near term.

There has been alot of talk about why the market has reacted as it has during the past two auction announcements, and why this has differed from the reaction to the first auction last year. We think the main reason is that during the first auction, bitcoin was in an upswing and looked poised to breakout substantially to the upside. During a bull market, it makes sense to pay more for the coins than market because you will likely be able to sell them at market once you receive them, at least for a small profit given the trend continues.

Conversely, now that bitcoin is in a protracted bear market, there is little incentive for auction participants to bid above market because they suspect that prices will be below the winning bid by the time the coins are received. Therefore, the market is anticipating that the winners will pay below current market value and can then dump at least some of them at the market price at that time for, again, at least a small profit. Regardless, there is no doubt that these events inject uncertainty into the market, which is not great for risk managers. We continue to bide our time and keep our powder dry.

Cheers,

@AKWAnalytics

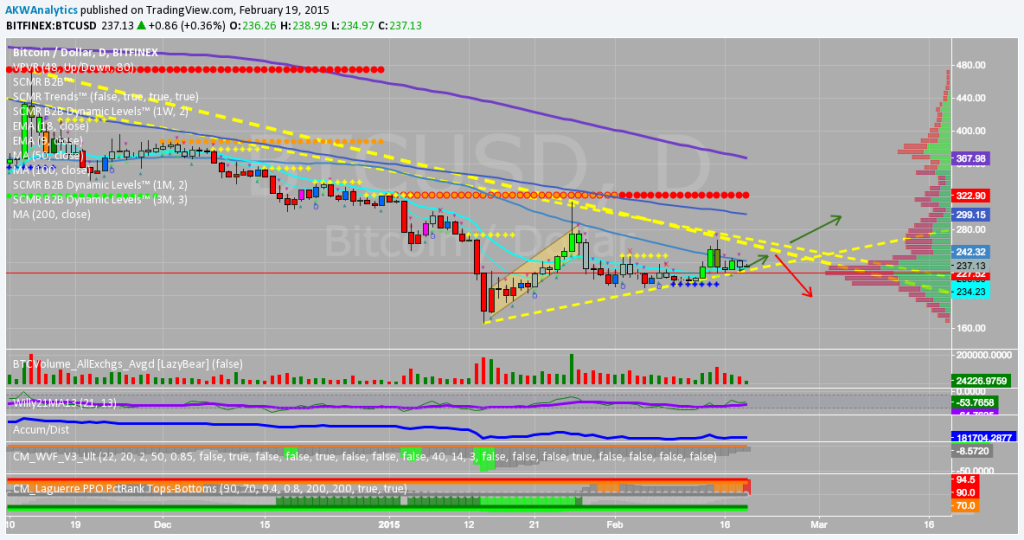

BTCUSD Daily chart [Bitfinex]

To learn more about the bitcoin forecast above, or to gain access to the full Weekly Report, Daily Updates, and real-time Price Alerts please visit bullbearanalytics.com today!

For more information on the Bitcoin BullBear, any of the markets we cover (Litecoin, Gold, Silver, S&P 500, Nasdaq 100, DAX 30, and select individual securities), or how to subscribe to our Premium Services, please visit the Bitcoin BullBear today!

Join Today for Full Access!

Happy trading and have a great BITday!

Disclaimer: Please always do your own due diligence, and consult your financial advisor. Author owns and trades bitcoins and other financial markets mentioned in this communication. We never provide actual trading recommendations. Trading remains at your own risk. Never invest unless you can afford to lose your entire investment. Please read our full terms of service and disclaimer at terms-conditions-disclaimer/.