The Bitcoin Outlook From Last Friday

On Friday, February 13, 2015, we issued the following bitcoin outlook to our premium members: “Long on a consolidation in the 236 to 238 $ range with a stoploss at 232 $ and upside targets at (1) 248 and (2) 257 $”. Below is the bitcoin chart right in the moment when we issued this Pro Trade.

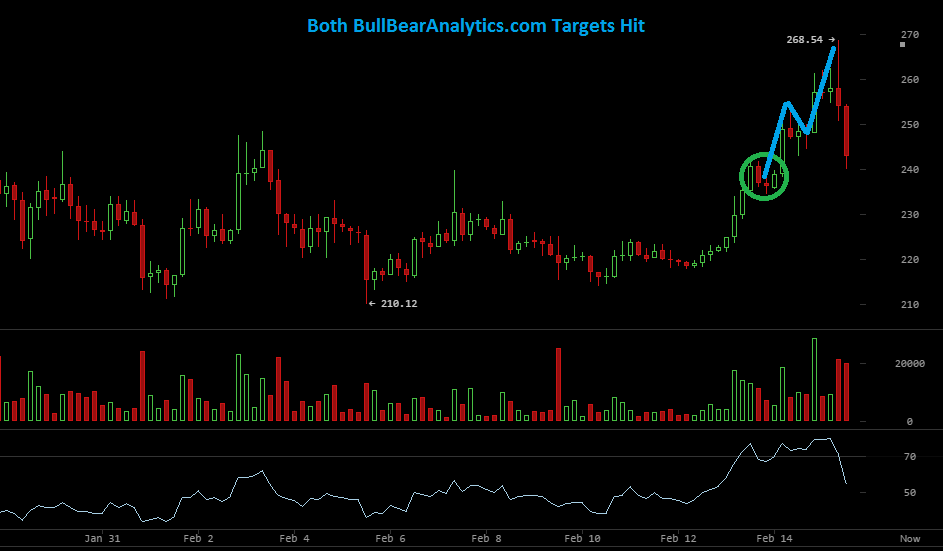

Bitcoin Outlook Chart from February 13, 2015

Bitcoin Prices Seem To “Follow” Our Bitcoin Outlook

As we can see below, bitcoin prices seem to have a twitter account and are “following BitcoinBullBear”.

First, the consolidation happened. This allowed for a great entry price at our ideal bitcoin price of 236 $.

Second, Bitcoin prices reached both targets from the Pro Trade. Right after reaching the bitcoin outlook target, bitcoin prices turned down hard. This shows that the resistance was indeed a serious one.

Bitcoin Outlook Chart from February 15, 2015

Bitcoin Outlook: UP or DOWN?

Of course, the next question is: Which direction will the next bitcoin wave roll? We answer this question constantly for our premium subscribers: We give detailed probabilities and insights on the directions of bitcoin prices.

We even have a special trial offer for one month subscriptions at 19.99 $ until February 28, 2015.

Get The Bitcoin Outlook as Premium Member

Have a great BITday!

@S3052

—

Do you want to learn more about Bitcoin Outlook, Our Premium In-Depth Weekly Report, Daily Updates, and real-time Price Alerts? Please visit BullBear Analytics now! The Bitcoin and other cryptocurrency forecast are available as part of the Active Pro Complete package.

For more information on the Bitcoin BullBear, any of the markets we cover (Litecoin, Monero, Gold, Silver, S&P 500, Nasdaq 100, DAX 30, and select individual securities), or how to subscribe to our Premium Services, please visit the Bitcoin BullBear today!

Get All Cryptocurrency Forecasts as Premium Member

Disclaimer: Please always do your own due diligence, and consult your financial advisor. Author owns and trades bitcoins and other financial markets mentioned in this communication. We never provide actual trading recommendations. Trading remains at your own risk. Never invest unless you can afford to lose your entire investment. Please read our full terms of service and disclaimer at terms-conditions-disclaimer/.