How The Bitcoin Forecast Was Nailed in 2013

It is Saturday and cold outside. I have been sitting on the couch for a while. Then, I started to look through some of the bitcoin forecast history. Then, I stumbled over the volatile 2013 period. Finally, I decided to share some of this history with you.

You will see in the following an interesting string of charts. This shows that technical analysis can avoid the confusing emotions during big rallies and declines. (Apologies for the various different chart layouts. But at that time, bitcoin charting was quite tedious. Often, charts had to be done manually since bitcoinwisdom or tradingview did not exist yet).

Bitcoin Forecast from April 8, 2013

Already month before, when bitcoin prices traded between 2-10 $, we indicated that there is way more upside, given where bitcoin prices traded in regards to the Elliott Wave structure.

“As we expected already many months ago when bitcoin prices were at 2-10 $, the bitcoin charts show that bitcoin prices are in a major Elliott Wave [III] up and the strength of the current rally is not really that surprising: It is a THIRD wave. Full stop.

And more recently, the bitcoin price rally has further accelerated as evident in the bitcoin chart above.

Bitcoin prices have been breaking out of several parallel trend channels consecutively. First, they broke out of the yellow bitcoin price channel. Then, bitcoin prices the cleared the turquoise channel.

Also, the key indicators MACD and RSI are still showing no signs of weakness or divergences.

Hence, the mid term trend remains UP and higher targets are ultimately possible.

As always, there will be trials and tribulations along the way: short term, and often sharp corrections are part of bitcoin history.”

At that moment, many people believed that the rally will stop even before reaching the blue trend channel. But no way: As we expected, the rally continued. Only 2 days later, bitcoin prices had risen another whopping +20% into the 220 - 230 $/BTC zone:

Bitcoin Forecast from April 10, 2013

However, at that moment, it was time to give our subscribers a warning.

“The bitcoin charts rally remains very strong and in theory higher prices of 300$, 400$, 500 $ and even more is possible. But here is the watch out: Given the exponential rise, there is an increasing likelihood that prices could pull back significantly within the next days / weeks.”

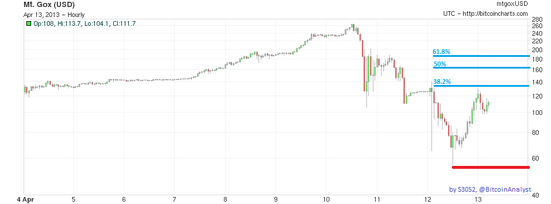

Bitcoin Forecast from April 13, 2013

And indeed, only hours after we gave this bitcoin forecast warning, prices started to correct by -80%+ Some people also used the word crash, which was not far from the truth:

Here is what we issued:

“After the predicted huge rally, it was clear that this needs to be corrected in some point. And it happened in the middle of the week with a -80% drop from 266 $ to 54 $. This sounds huge and it is a huge sell off. At the same time, BTCUSD is still up many thousands of percent from the start of trading, the “bitcoin IPO”, in summer 2010.

We have warned on April 10 about a imminent possibility for a sharp correction only hours before it happened.

After the heavy decline, bitcoin prices rallied +239% from 54 $ to last night’s high of 129 $.

The question is now, what is next? There is one key level to watch short term: Bitcoin prices should not trade below 54 $ any more.

If this level can be defended, there are chances that bitcoin prices can retrace more of the sell-off to higher targets: 136 (38.2% Fibonacci retracement), 161 (50%) and 186 (61.8%).

And even new highs above 266 $ are possible.”

The next part is history: Bitcoin prices indeed reached our first target of 500 $ afterwards and then topped in our target zone of “1,000 - 1,200 $” early 2014.

Get All Cryptocurrency Forecasts as Premium Member

Have a great BITday!

@S3052

—

Do you want to learn more about Bitcoin Forecasts, Our Premium In-Depth Weekly Report, Daily Updates, and real-time Price Alerts? Please visit BullBear Analytics now! The Bitcoin and other cryptocurrency forecast are available as part of the Active Pro Complete package.

For more information on the Bitcoin BullBear, any of the markets we cover (Litecoin, Monero, Gold, Silver, S&P 500, Nasdaq 100, DAX 30, and select individual securities), or how to subscribe to our Premium Services, please visit the Bitcoin BullBear today!

Get All Cryptocurrency Forecasts as Premium Member

Disclaimer: Please always do your own due diligence, and consult your financial advisor. Author owns and trades bitcoins and other financial markets mentioned in this communication. We never provide actual trading recommendations. Trading remains at your own risk. Never invest unless you can afford to lose your entire investment. Please read our full terms of service and disclaimer at terms-conditions-disclaimer/.