Originally published in the BullBear Analytics Weekly Report released on 1/28/2014. Partial excerpt only. Written by @AKWAnalytics.

As much as many readers will be displeased to hear that there is still substanial near term risk to the downside, take solace in the notion that there appears to be a light at the end of the tunnel, just now barely peeking through the darkness. Patience.

Bear markets are tough, especially ones that are not subject to the whims of central bankers, yet are subject to the full range of human emotions and our good ole friend ‘supply and demand’. A commodity market in an inflationary condition, such as bitcoin is right now, must maintain a steady level of demand if it is to remain stable. This is hard to do after the popping of a huge bubble with extreme sentiment, but as any commodity trader will tell you “the best cure for low prices is lower prices, and the best cure for high price is higher prices.” The constant supply of newly mined coins will continue to come to market until a true economic equilibrium is reached wherein the number of buyers and sellers is more in line with the true dynamics of the underlying economy.

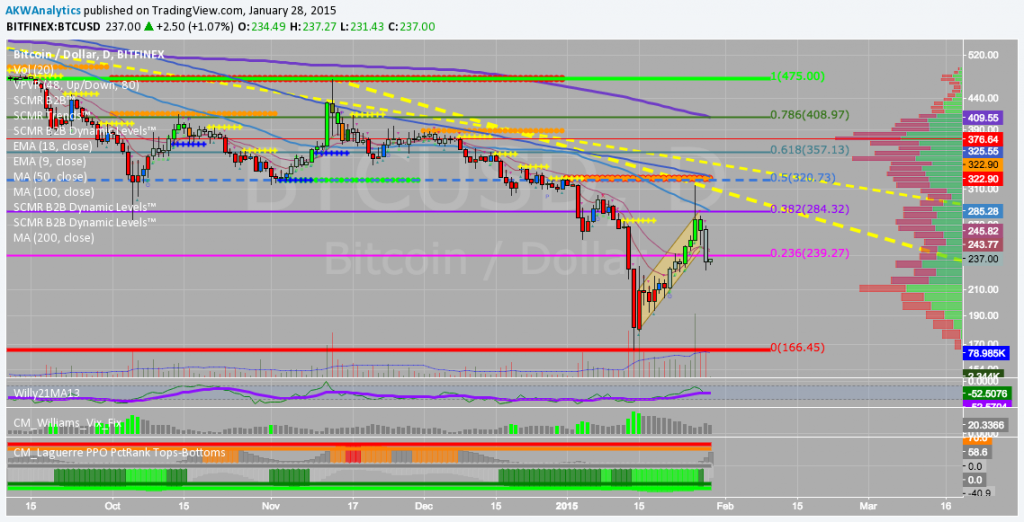

Exactly when and at precisely what price this equilibrium occurs is impossible to predict, however technical analysis can give us clues and help us make informed decision that otherwise would be missed by the fundamental analyst. So what are the technicals telling us? They are saying that there remains considerable risk for lower prices in the short run as bears continue to hold the ball for the time being. That being said, it now appears as though there is a resolution to the upside coming this year, following the ultimate low, if it isn’t already in.

We are watching 120 $ very closely, but will be looking to establish long term long positions in the 130 to 150 $ range. If we don’t get that low, even better for the bulls as in that case a double bottom or Adam and Eve would be in, and the desending wedge would be resolved to the upside. Not all bad, but not all good either. Such is life in Bitcoinland…

Cheers,

@AKWAnalytics

BTCUSD Daily chart [Bitfinex]

To learn more about the bitcoin forecast above, or to gain access to the full Weekly Report, Daily Updates, and real-time Price Alerts please visit bullbearanalytics.com today!

For more information on the Bitcoin BullBear, any of the markets we cover (Litecoin, Gold, Silver, S&P 500, Nasdaq 100, DAX 30, and select individual securities), or how to subscribe to our Premium Services, please visit the Bitcoin BullBear today!

Join Today for Full Access!

Happy trading and have a great BITday!

Disclaimer: Please always do your own due diligence, and consult your financial advisor. Author owns and trades bitcoins and other financial markets mentioned in this communication. We never provide actual trading recommendations. Trading remains at your own risk. Never invest unless you can afford to lose your entire investment. Please read our full terms of service and disclaimer at terms-conditions-disclaimer/.