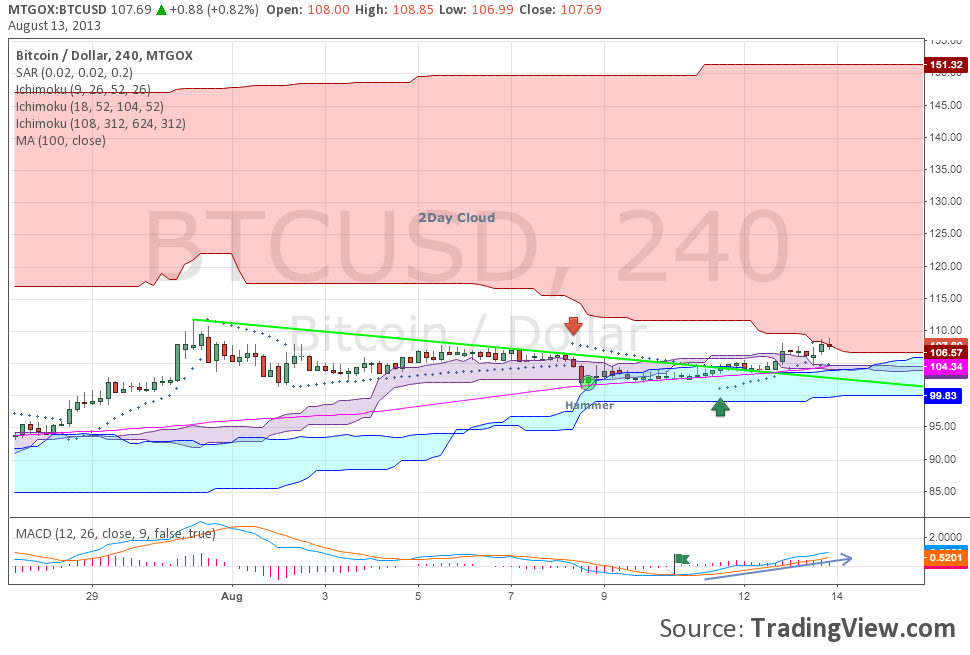

Originally published in a Bitcoin Bull Bear short term market update on 8/13/2013

Market Comentary: The rally has continued as predicted, breaking resistance at 105 $ on good

volume. The market is now digesting the move up to 108 $, which is the

next major resistance level and is being tested now (edit: we have since broken out and are now holding support at 108 $). The technical picture

continues to develop nicely, which reinforces our bullish outlook in the

short term. More specifically, on the updated 240min chart, the 9 hour

Ichimoku Cloud has been broken to the upside and is now acting as support

(shown in purple), and the MACD and SAR continue to indicate a continued

bullish trend. One negative is the 2day Ichimoku Cloud looming overhead as

resistance (shown in red), however we are ever so close to breaking through

the cloud and moving higher still (edit: this Cloud has been penetrated).

A sustained move above these levels makes a test of the neckline/old highs

at 110 - 112$ extremely likely, and a move beyond this range would make a

move to 118 - 124 $ more probable. This would be a significant move if

confirmed on volume and might catapult BTC/USD into a new, higher trading

range. Probability XX/XX (subscribers only).

What is the alternative? A failure to hold key support in the 98 - 100 $

zone would put the BitBears back in charge in the short term and the market

could see a sharp move lower to test the VERY strong support band from 86 -

88 $. This level must hold in order for many medium term patterns to

remain valid. Probability XX/XX (subscribers only).

BTC/USD 240min chart:

For more information on the Bitcoin market, or any of the other markets we cover (Litecoin, Gold, Silver, S&P 500, DAX 30) please visit Digital Currency Research. For a limited time only (expires 8/19/2013) use promo code: bbbsummer for six weeks free with any 3 month (+) subscription. Happy trading!

AKWAnalytics