Written by @AKWAnalytics.

GLOBAL INVESTORS PRICE IN GREXIT AS ECB/IMF NEGOTIATIONS DETERIORATE; CAPITAL CONTROLS IMPLEMENTED IN GREECE

Quite a newsy summer Monday it was as Greece continues to be on the brink, Puerto Rico is straight up broke, and China had to ease further over the weekend in order to try to stem the bleeding in their parabolic equity markets (which are now correcting). Given no Greek resolution and low liquidity you would think volatility would pick up through the week, however with the US heading into a holiday weekend and European negotiations now pushed back to Sunday, we suspect the volatility to quiet slightly following the New York open tomorrow.

With that said, and given how much remains up in the air from an exogenous risk perspective, we take solace in the fact that price is truth and the charts never lie. They are our cryptic maps though this carnivorous jungle known as the global financial markets, and at the very least they provide us with shelter, harbor, and sanctuary during the most trying of times. As we have said before, patience is our most precious virtue, dry powder our most important resource, and the charts our most valuable source of information. We must use all of them wisely!

Forex

What a day in the currency markets as prices in EURUSD (Fiber), covered a full 300 pips from gap open to rally close. Despite some profit taking early in the pre-Asia trade today, the signal sent yesterday was a powerful one. The market seems to be telling us that a Euro with no Greece is a stronger Euro, and if a deal happens then risk is back on. The only fly in the ointment to this seemingly perfect bullish setup is an extremely active central bank known as the ECB, run by a man they call Draghi, who is ready to keep the QE pump running at all costs. Again, we must lean on the technicals as uncertainty is running at historical highs in the forex markets.

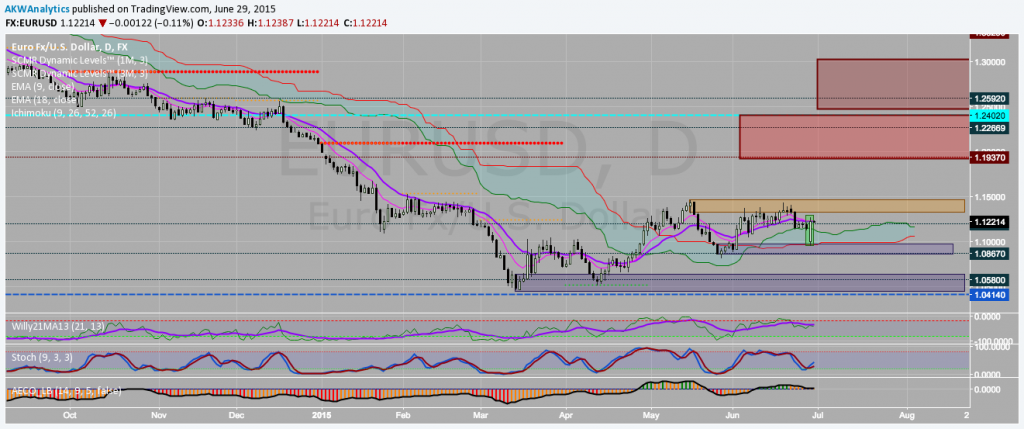

Despite an outside day today in fiber (bullish engulfing), it appears to us that the pair remains range bound between a demand area from 1.085 to 1.10, and a supply zone from 1.132 to 1.147. Until one of these areas is cleared on a clean breakout, then we must assume that we are trading in a range. The indicators seem to confirm this as Willy is dancing around overbought territory already, ergotics are divergent, and the Ichimoku Cloud, despite providing support on the drop today, is close to turning bearish.

Given that price is currently located in no man’s land within the aforementioned range, we will be watching the Greek fireworks from the sidelines for now. That said, if a resolution favorable to global risk assets materializes then we will want to start hunting for long us dollar setups in all major pairs once again.

Fiber Daily

Stocks

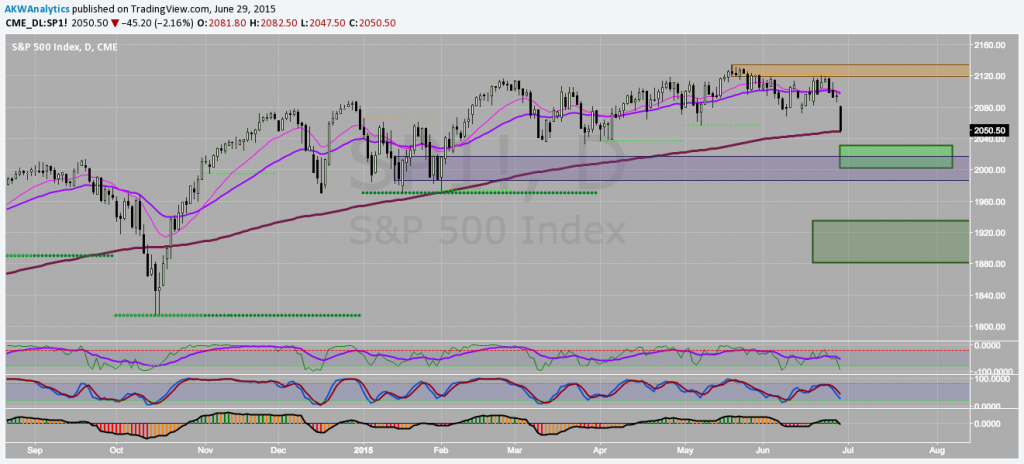

Stocks were heavy yesterday as risk-off dominated the global markets on Grexit fears. As the price of the S&P 500 has almost instantaneously found itself sitting right on the 200day SMA on a gap move, we suspect that at some point this gap will need to be filled regardless of which direction stocks ultimately head. That said, until we get more clarity out of the Eurozone stocks will have a difficult time making much headway to the upside, therefore selling rallies might not be a bad idea for the time being.

Technically speaking, momentum in the S&P 500 has taken a turn in favor of the bears as Willy has broken to the downside, the Stochastic is accelerating lower, and the lower timeframe institutional EMA’s are about to cross. If the 200day SMA is broken then we expect at least a washout spike down into the nearest OTE long zone and demand area between 2000 and 2030. If this move is more than a spike, then the next stop on the road to correction is the intermediate term OTE sweet spot and order block way down around 1900. Today’s New York session will be very interesting and telling as to how resilient equity investors remain, and whether volatility stays elevated or not (BTFD?!?)

S&P500 Daily

Metals

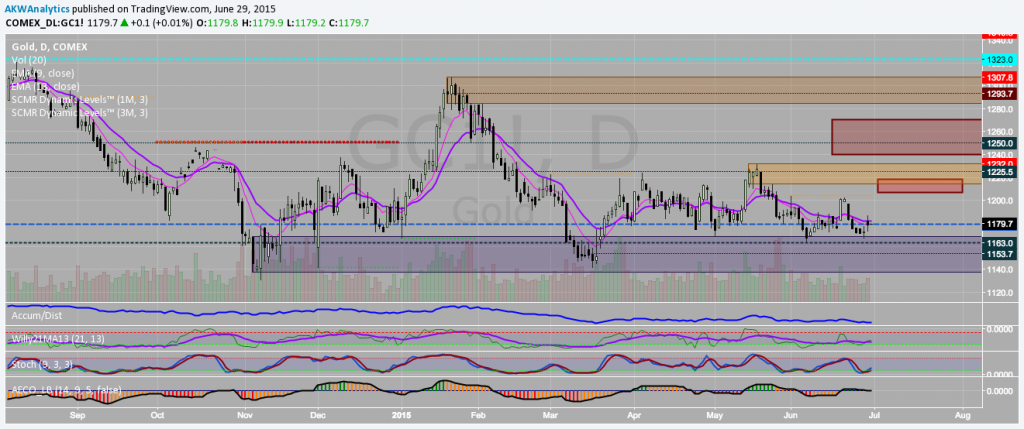

Unfortunately for the bulls, gold was a big disappointment in terms of relative performance in light of the global risk environment yesterday. Capital controls, ATM lines, wire restrictions, and default-speak all should have sent gold prices substantially higher, however sell side pressure seems relentless in spite of logic and fundamentals. This is precisely the reason we use the charts as our guides, and not a belief in perfectly efficient markets.

The charts point to more consolidation at the very least, and remain overall bearish in terms of technical price action. In our opinion, the minor move higher yesterday, in fact, had nothing to do with Greece, but was rather a technical bounce off of an institutionally important demand zone and historical support level. Despite a bullish Willy and Stochastic, A/D continues to show gold being distributed during the current consolidation.

Putting all of this together tells us that “mixed” is a perfect work for this market currently. If price can get past the near term OTE short zone and supply area from $1210 to $1230 then we will be changing our tune to a bullish one, otherwise we will be looking to sell rallies into the highlighted areas on the chart.

Gold Daily

Happy Trading!

Cheers,

@AKWAnalytics

—

To learn more about the BullBear Analytics, or to gain access to our full line of Weekly Reports, Daily Updates, and real-time Price Alerts for bitcoin and other cryptocurrencies, please visit bullbearanalytics.com today!

For more information on the Bitcoin BullBear and Crypto BullBear, or on how to subscribe to our Premium Services, please visit BullBear Analytics today!

Join Today for Full Access!

Happy trading and have a great BITday!

Disclaimer: Please always do your own due diligence, and consult your financial advisor. Author owns and trades bitcoins and other financial markets mentioned in this communication. We never provide actual trading recommendations. Trading remains at your own risk. Never invest unless you can afford to lose your entire investment. Please read our full terms of service and disclaimer at terms-conditions-disclaimer/.