Originally published in the Bitcoin BullBear Weekly Report released on 2/4/2015. Partial excerpt only. Written by @AKWAnalytics.

What an interesting day in the bitcoin space! In the middle of the day the price began to spike on news that the revised BitLicense had been released, only to be smacked back down an hour later on news that Ross Ulbricht had been found guilty on all seven charges he faced, four of which carry potential life sentences. No doubt the powers that be are trying to send a message, but will they succeed?

Despite all of the to-do about the BitLicense and Silk Road, the biggest news of the day, in our opinion, came out of western Europe. In an unprecedented move by the Italian Central Bank, they have dismantled AML requirements for all virtual currency firms that operate in their jurisdiction. No reporting, no tracking, no harrassment (we hope). If this indeed turns out to be the case, then we could be looking at the first domino to fall in regards to liberalizing policymakers’ views on bitcoin regulation.

Ben Lawksy of the NYDFS has taken the opposite approach to digital currency regulation by imposing innovation-stifling compliance requirements in order to satisfy the interests of his constituency. He loves the banks, loves government, and has political aspirations. All of this is a recipe for disaster for the state of New York in the long run, and any other state that adopts similar policies, with respect to financial technology, and in our opinion will drive capital and talent from the state over the next few years.

It will be interesting to see how the US regulators respond to the action in Italy, but it will be even more interesting to watch this play out in the market. Over the next five to ten years it will be blatantly obvious which course of action was the proper one, and we suspect that Italy will come out looking pretty good (for once ![]()

As far as DPR and Silk Road, “drugs are bad, mmmkay…”

Cheers,

@AKWAnalytics

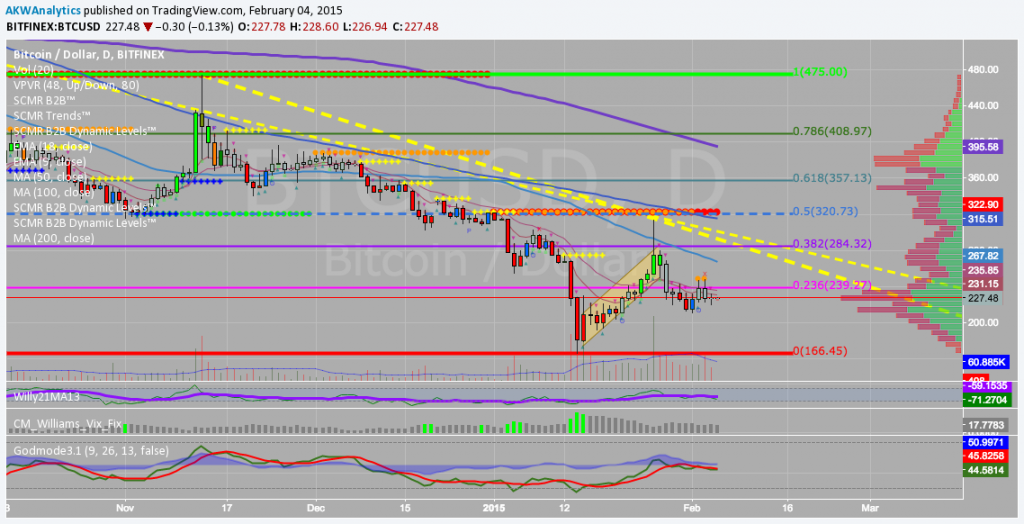

BTCUSD Daily chart [Bitfinex]

To learn more about the bitcoin forecast above, or to gain access to the full Weekly Report, Daily Updates, and real-time Price Alerts please visit bullbearanalytics.com today!

For more information on the Bitcoin BullBear, any of the markets we cover (Litecoin, Gold, Silver, S&P 500, Nasdaq 100, DAX 30, and select individual securities), or how to subscribe to our Premium Services, please visit the Bitcoin BullBear today!

Join Today for Full Access!

Happy trading and have a great BITday!

Disclaimer: Please always do your own due diligence, and consult your financial advisor. Author owns and trades bitcoins and other financial markets mentioned in this communication. We never provide actual trading recommendations. Trading remains at your own risk. Never invest unless you can afford to lose your entire investment. Please read our full terms of service and disclaimer at terms-conditions-disclaimer/.